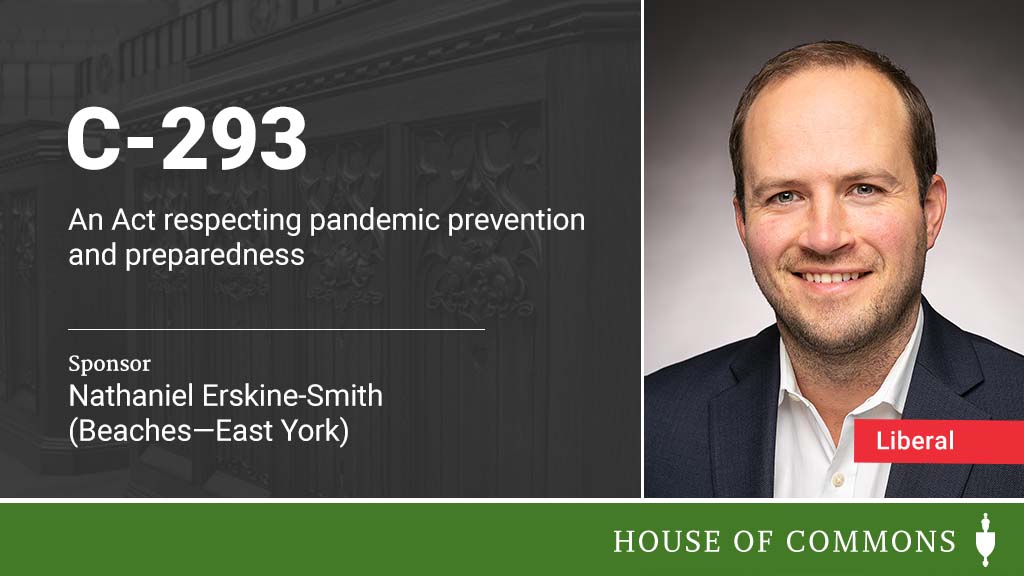

M.P. BEACHES-EAST YORK

Nathaniel Erskine-Smith

I couldn’t be luckier to represent our community where I grew up and call home with Amy, Mack, and Crawford.

Thank you for the opportunity to make a positive difference, and don’t hesitate to be in touch if there’s anything we can do to help you, or to advocate for an idea on your behalf.